February 2015,

I Ed. ,

58 pages

Price (single user license):

EUR 800 / USD 864

For multiple/corporate license prices please contact us

Language: English

Report code: M11

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The report analyses the e-commerce market for furniture and related products – lighting fixtures, appliances, furnishings – in China.

Current size of the Chinese e-commerce furniture market, forecasts of its future developments, breakdown by products are provided. Key characteristics of the Chinese e-commerce market, as e-shoppers habits, O2O retail development, payment and delivery, role of social media, are also presented, with relevant examples.

The report includes furniture online sales and other key figures for the first eighteen major players of the Chinese market.

It also provides addresses and e-mails for more than one hundred major platforms selling furniture, divided by product segment.

Selected companies

Aijiahome, Amazon.cn, Dangdang, Hoba, Homekoo, Ikea China , JD, Jiaju, Kinhom, Liwai, Meilele, Mmall, Oppein, Qumei, Suning Yigou, Taobao, Yangshiwang

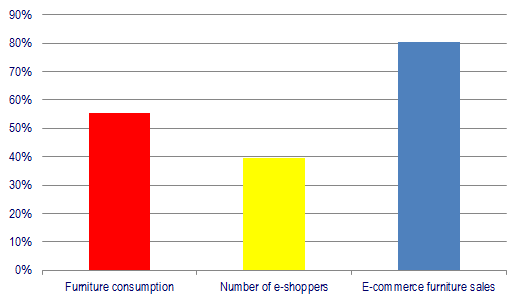

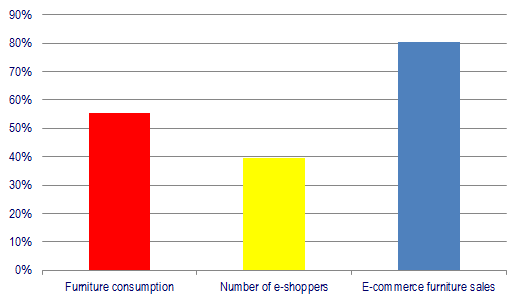

China: overall furniture consumpion, number of e-shoppers, e-commerce furniture sales, growth rates, 2013 on 2010

Since 2009 China has been the first furniture consumer in the world, accounting for more than 30% of global consumption and keeping a steady upward path. Meanwhile also e-commerce is experiencing an impressive boom, with the number of e-shoppers reaching 271 million in 2013 from 194 three years before. The growing Chinese furniture market definitely participates in this trend. From 2010 to 2013 online furniture sales rose by about 80%. 9 out of 12 of the greatest online platforms specialized in selling furniture and related products showed annual online sales increasing by more than 20% during the last year.

In order to grasp opportunities stemming from this fast development of the Chinese market, companies have to take into account its peculiar aspects, ranging from Chinese e-shopper specific habits to the current trend towards online-offline integration

Abstract of Table of Contents

Methodological notes

Research field and tools

Terminology

China furniture market

Macroeconomic environment

Furniture market trend

- Furniture consumption in China from 2004 to 2013, estimates for 2014

Furniture import trend

- Furniture import in China from 2004 to 2013

- Breakdown of furniture import by main countries of origin

E-commerce development

Timeline of e-commerce development

E-commerce in China

- Basic data: number of internet (PC and mobile) and social media users, number of e-shoppers, from 2008

- China e-commerce market size for 2010-2017

- Characteristics of e-commerce in China

Online furniture market: size and trends

- China e-commerce furniture market: estimates for 2010, 2013, forecasts for 2015, 2020

- Top e-commerce furniture-related websites by year of foundation and unique visitors

- Online furniture consumption: breakdown by product

- Observed trends

Leading players

Overview of main players selling furniture and related products online

- Total e-commerce sales, annual growth, furniture and home-related e-commerce sales for the greatest players of the market

- Top e-commerce platforms focused on furniture

- Top e-commerce platforms focused on bathroom, office, children furniture

- Top e-commerce platforms selling lighting and appliances

- Top luxury platforms selling also furniture and related products

- Other major platforms selling furniture and related products

Appendix: list of useful contacts

The report analyses the e-commerce market for furniture and related products – lighting fixtures, appliances, furnishings – in China.

Current size of the Chinese e-commerce furniture market, forecasts of its future developments, breakdown by products are provided. Key characteristics of the Chinese e-commerce market, as e-shoppers habits, O2O retail development, payment and delivery, role of social media, are also presented, with relevant examples.

The report includes furniture online sales and other key figures for the first eighteen major players of the Chinese market.

It also provides addresses and e-mails for more than one hundred major platforms selling furniture, divided by product segment.

China: overall furniture consumpion, number of e-shoppers, e-commerce furniture sales, growth rates, 2013 on 2010

Since 2009 China has been the first furniture consumer in the world, accounting for more than 30% of global consumption and keeping a steady upward path. Meanwhile also e-commerce is experiencing an impressive boom, with the number of e-shoppers reaching 271 million in 2013 from 194 three years before. The growing Chinese furniture market definitely participates in this trend. From 2010 to 2013 online furniture sales rose by about 80%. 9 out of 12 of the greatest online platforms specialized in selling furniture and related products showed annual online sales increasing by more than 20% during the last year.

In order to grasp opportunities stemming from this fast development of the Chinese market, companies have to take into account its peculiar aspects, ranging from Chinese e-shopper specific habits to the current trend towards online-offline integration

Abstract of Table of Contents

Methodological notes

Research field and tools

Terminology

China furniture market

Macroeconomic environment

Furniture market trend

- Furniture consumption in China from 2004 to 2013, estimates for 2014

Furniture import trend

- Furniture import in China from 2004 to 2013

- Breakdown of furniture import by main countries of origin

E-commerce development

Timeline of e-commerce development

E-commerce in China

- Basic data: number of internet (PC and mobile) and social media users, number of e-shoppers, from 2008

- China e-commerce market size for 2010-2017

- Characteristics of e-commerce in China

Online furniture market: size and trends

- China e-commerce furniture market: estimates for 2010, 2013, forecasts for 2015, 2020

- Top e-commerce furniture-related websites by year of foundation and unique visitors

- Online furniture consumption: breakdown by product

- Observed trends

Leading players

Overview of main players selling furniture and related products online

- Total e-commerce sales, annual growth, furniture and home-related e-commerce sales for the greatest players of the market

- Top e-commerce platforms focused on furniture

- Top e-commerce platforms focused on bathroom, office, children furniture

- Top e-commerce platforms selling lighting and appliances

- Top luxury platforms selling also furniture and related products

- Other major platforms selling furniture and related products

Appendix: list of useful contacts

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Furniture retailing in Poland

February 2024, I Ed. , 29 pages

Home furniture retailers in Italy: the main retailers in Italy are analysed through performance data, product specialisation, retail format, number of stores and website for selected ones. For 21 major retailers, profiles with additional information are also included. The study covers a total of 132 home furniture retailers

Furniture retailing in Czech Republic

February 2024, I Ed. , 29 pages

Home furniture retailers in Italy: the main retailers in Italy are analysed through performance data, product specialisation, retail format, number of stores and website for selected ones. For 21 major retailers, profiles with additional information are also included. The study covers a total of 132 home furniture retailers

Furniture retailing in Switzerland

February 2024, XVII Ed. , 23 pages

Home furniture retailers in Switzerland: the main retailers in Switzerland are analysed through performance data, product specialisation, retail format, number of stores and website for selected ones. For 8 major retailers, profiles with additional information are also included. The study covers a total of 31 home furniture retailers

Furniture retailing in the United Kingdom

February 2024, XVII Ed. , 29 pages

Home furniture retailers in United Kingdom: the main retailers in United Kingdom are analysed through performance data, product specialisation, retail format, number of stores and website for selected ones. For 20 major retailers, profiles with additional information are also included. The study covers a total of 97 home furniture retailers